外媒:腾讯公司渐成世界游戏产业巨人

本文原作者为蒂姆.米罗(Tim Merel,IBIS Capital公司董事),他是一名关注游戏产业的投资银行家,将应英国**邀请于9月28日在上海世博园英国馆,面向100多名来自电子游戏、媒体、投资领域的高级主管演讲他的报告《全球电子游戏投资情况回顾》。

Tencent is becoming a game juggernaut

腾讯公司对西方国家来说虽然相对陌生,但值得所有同行警醒的是,这个中国公司正悄悄成长为一个世界游戏产业巨头。在解释腾讯的来历之前,我们首先要了解以下一组数据:

*目前中国互联网普及率为29%,拥有3.82亿网络用户;

*到2015年,中国互联网普及率预计将达56%;

*腾讯掌握了中国在线/手机游戏市场的最大份额(包括即时信息工具、游戏、电子商务、搜索引擎、手机增值服务等领域);

*腾讯的市值已经达2410亿元人民币(约350亿美元);截止今年8月,腾讯的企业价值是该公司去年EBITDA(利息、税金、折旧、分期付款前的收入)的35倍,这个数字甚至超过了Activision Blizzard、Electronic Arts、GameStop、Take-Two、THQ、Atari、Game Group和Ubisoft这几个公司的总和。

那么,腾讯与索尼、微软、任天堂这些大牌相比,情况又如何呢?腾讯的市值介于索尼和任天堂之间,当然它还远不能与微软匹敌,但我们在此讨论的是游戏软件而非硬件设备,别忘了,索尼和微软还包揽了多项副业,腾讯光凭游戏一份家业当然不能与它们多元化发展建立的帝国相提并论。

腾讯商业路线恰与市场走向合拍

腾讯的运营利润率约50%,其中在线/手机游戏(包括多人在线游戏、棋牌游戏、休闲/社交游戏)占总营收的40%以上。目前,腾讯正从原来的虚拟道具创收(采用这种模式,平均每个游戏用户付费相对较高),转向以游戏订购为主(这种模式的短期营收相对减少,但波动性较小)的赢利模式。这支中国游戏产业大军所采用的战术实具远见,而西方游戏市场预计未来12至18个月内才会出现这种转变趋势。

更为重要的是,腾讯这种极具黏性的商业模式,无论在线上、线下还是手机(不仅仅局限于腾讯游戏),都能轻而易举地虏获新玩家,留住回头客。它利用自己不断增强的实力,进行交叉促销、向上促销和交叉销售。Facebook如果真想大量吸金,恐怕还得先向腾讯取经。

腾讯大获成功的天然优势

以下图表反映了全球游戏产业2005年至2014年的发展趋势,表明全球在线/手机游戏的市场营收一路增长强劲,而掌机游戏则业绩平平。腾讯恰好一直主攻在线/手机游戏,确实是抢占了先机。

2005至2014年全球电子游戏产业营收曲线图(单位:百万美元)

Global Video Game Sector Revenue

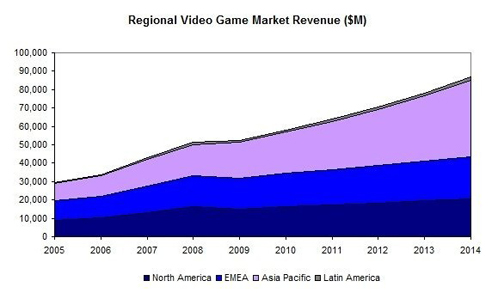

以下图表则反映了全球各地区游戏产业营收情况,表明亚太市场未来三四年内必将成为世界游戏产业营收冠军,欧洲位于次席,北美则排行第三。而中国无疑是亚洲最大的市场,腾讯又是中国游戏产业霸主,正可谓占尽天时地利。

2005至2014年全球各地区游戏市场营收曲线图(单位:百万美元)

Regional Video Game Market Revenue

下图则反映了腾讯过去5个季度的游戏营收情况,表明腾讯在该时期中的游戏营收增长了49%,仅腾讯迷你休闲游戏一项的高峰期同时在线用户就达700万人,相当于比爱尔兰全国人口还要多的人同时挂在这类游戏上,要注意的是,这里说可不是每月700万用户,而是同一时刻700万用户。在所有的腾讯游戏系列中,高峰期同时在线用户约2000万,仅略少于澳大利亚全国人口,这就是中国排行第一的游戏公司所建立的赫赫战绩。

腾讯公司2005至2010年5个季度游戏营收曲线图:

Tencent Quarterly Game Revenue

腾讯很有可能马上就要与西方对手同台竞争,因为我曾有幸与腾讯互动娱乐业务系统副总裁王波共进午餐,了解到腾讯正积极向新领域扩张的情况。腾讯目前的年度市场增长率已经降温,从原来超过70%的增长率降到了目前的30%,腾讯正铆足了劲,准备向国内和海外市场的其他领域发力。

腾讯在国内拥有不少重量级合作伙伴,主要包括:

*中国联通(主要合作范围:电信服务、3G业务、运营服务、“QQ钱包”)

*湖南电视台(主要合作范围:真人秀、动画片、在线/手机游戏)

*中国招商银行(主要合作范围:金融服务)

腾讯的海外主要合作伙伴包括:

*Digital Sky Technologies(俄罗斯投资公司,曾投资Facebook、Zynga、Mail.ru等公司)

*Vina Games(越南在线游戏/网络公司)

*MIH India Global Internet(印度环球网络公司,主营软件、内容及商标等业务)

*Naspers(腾讯第一大股东、非洲最大的传媒公司,拥有腾讯36%的股份)

几乎所有北美、欧洲的电子游戏、网络科技、媒体等行业的公司都不免忧心忡忡,唯恐腾讯进军冲击本土市场。在此,我对西方公司唯一的建议就是,要知己知彼,提前学会与腾讯打交道,因为腾讯带来的也是商机。腾讯称雄国际游戏产业,只是一个时间早晚的问题,西方同行们要开始警惕了。

China’s Tencent is quietly becoming a game juggernaut

This guest post was first published by www.gamesindustry.biz as part of a new monthly column by Tim Merel, a director at IBIS Capital. Merel is an investment banker with expertise in games. The UK government has asked him to present his Global Video Games Investment Review to 100 senior executives from video game companies, media companies and investors at the Shanghai World Expo UK Pavilion on September 28.

Tencent is one of the greatest game companies that you may never have heard of. From the perspective of money in the games business, the Chinese company is becoming more and more important.

To explain the praise for Tencent, let’s start with some data.

* China has 29 percent internet penetration; that adds up to 382 million users.

* China is forecast to reach 56 percent internet penetration (754 million users) by 2015.

* Tencent holds dominant or leading stakes in many Chinese online/mobile markets (instant messaging, games, e-commerce, search, and mobile services).

* Tencent’s Chinese games market share was 20 percent in 2009, forecast to hit 27 percent by 2012.

* Tencent’s market capitalization – which is in the order of ¥241 billion ($35 billion) with an enterprise value of 35 times 2009 EBITDA (earnings before interest, taxes, depreciation and amortization — a good measure of earnings power) in August 2010 – was greater than Activision Blizzard, Electronic Arts, GameStop, Take-Two, THQ, Atari, Game Group and Ubisoft combined.

So what about Sony, Microsoft and Nintendo? Okay, so Tencent is about halfway between Sony and Nintendo’s market capitalization, and it is nowhere near as large as Microsoft. But (a) we’re talking about game software, not hardware, and (b) Sony and Microsoft do a couple of other things too.

Tencent’s integrated model is where the market is headed

Tencent generates around a 50 percent operating margin. Online/mobile games (massively multiplayer online games, board & chess, casual/social) generate more than 40 percent of its revenue. Tencent’s business model appears to be migrating from virtual items (which have a higher average revenue per user) to subscriptions (short term revenue reduction, but lower volatility), which is a reversal of the trend they started.

You can expect to see that same trend take hold in Western markets in 12 months to 18 months, which is roughly the lag between China’s pioneers and the West’s followers. Of great importance, Tencent has an integrated business model with upgrades and privileges across online, mobile and offline (not just games), delivering a significant advantage for customer acquisition, development and retention. It capitalizes on enhanced capabilities to cross-promote, upsell and cross-sell. Facebook could learn a lot from them about how to make even more money.

Tencent has some natural advantages which help enormously

The first chart below contrasts the growth in online/mobile games with the flat console games market, which is great if you’re a pure online/mobile company like Tencent.

The next chart helps to clarify things further, forecasting that Asia-Pacific will become the number one market by revenue, with Europe at number two and North America at number three.

A very large proportion of Asia’s strength comes from China — Tencent’s home market — where online/mobile games account for the bulk of revenue.

Whether or not you have faith in the forecasts themselves, directionally they’re correct. The videogames market is going online and mobile, with China a large part of those markets. Again, that’s great if you’re the leading player in online/mobile games in China.

A nickel ain’t worth a dime anymore+, but Tencent is worth a whole lot more. And what does all of this produce? 49 percent games revenue growth over the last five quarters, and around seven million peak concurrent users of Tencent’s mini casual games alone. Snap your fingers, and more than the population of Ireland are playing a Tencent mini casual game – not 7 million uniques per month, 7 million uniques right now.

Across the full Tencent games portfolio, you reach around 20 million peak concurrent users, or slightly less than the population of Australia. This is what happens when you’re the number one Chinese games company.

Tencent will be in your market soon, if it isn’t already. I was lucky enough to have lunch with Bo Wang from Tencent recently, and it is clear that despite Tencent’s advantages the company is actively expanding into new areas. Now annual market growth has cooled to a mere 30 percent (from 70 percent-plus), Tencent is looking to leverage its strengths across segments domestically and internationally.

But as with all things Tencent, this isn’t just talk and it isn’t small. The company has domestic partnerships:

* China Unicom (fixed line, 3G, operations, “QQ Wallet”)

* Hunan TV (talent, animation, online/mobile games)

* China Merchants Bank (financial services)

And it has international partnerships/investments:

* Digital Sky Technologies (Facebook, Zynga, Mail.ru investor)

* Vina Games (Vietnamese online games/internet)

* MIH India Global Internet (licensed software, content & trademarks)

* Naspers (36 percent Tencent investor) with global reach in high growth markets

All the major videogame, technology and media companies in North America and Europe are both fascinated and slightly nervous about the major Chinese companies entering their home markets. The only advice I can give is to learn from Tencent fast, because these guys mean business and they know what they’re doing. It is only a matter of time before they become as strong internationally as they are at home. So watch out!(source:venturebeat)

声明:英文原文采用venturebeat,转载请保留版权信息,谢谢!

来源:游戏邦

关于腾讯的新闻

- (2024-04-25) 曾经的的剑灵开局封神!如今剑灵2开局疯神!实在忍不住吐槽

- (2024-04-23) QQ飞车手游联动初代萌王,人气冲破两千万,网友:和老干妈联动

- (2024-04-23) 《DNF手游》5月公测,网友喊话网易,魔兽5月开服双方一决高下

- (2024-04-22) 不愧是DNF!手游定档5.21上线 腾讯股价上涨超5%

- (2024-04-22) 腾讯公布未成年人限玩日历:五一假期共计可玩9小时